Economy of Openness

Slovakia Investment Incentives

R&D: The R&D tax instrument allows for an additional deduction of 100% of R&D costs (effectively the costs are deducted twice) and is available nationally. Additionally, technology centers, defined as establishments, where technologically advanced products, technologies, or manufacturing processes are being developed or innovated to use them in production or increase added value may benefit from a few investment incentives. Regional aid tools are corporate income tax exemption, cash grants for tangible and intangible assets, contributions for newly created jobs, and rent or sale of public real estate at a discounted price. It is necessary to meet not only criteria regarding the creation of new jobs and incurrence of expenditures but also the requirement on appropriate salary levels.

Jobs creation & CAPEX: In 2023, to support the economy following the aggression against Ukraine by Russia, each project in industrial production is considered as a project implemented in the priority area (previously only those selected areas could count on lower entry thresholds). Aid for manufacturing projects is provided in the following four forms: corporate income tax exemption, cash grant for tangible and intangible assets, a contribution for newly created jobs, and rent or sale of public real estate at a discounted price. There are conditions of the minimum investment amount, the share of new technological equipment to eligible costs (between 30% and 60%), and the creation of new jobs depending on the unemployment rate in the region and the applied forms of investment aid. In case of an investment in the expansion of capacity, there is an obligation to increase production volume or production turnover by at least 5%.

The same instruments are available for investments in shared services. Similarly to aid for technology centers, a criterion of appropriate salary levels is as important as meeting criteria for new jobs and incurrence of expenditures.

Overview: Aid intensity varies between the regions and may reach from 30% to 60% (for SMEs it can it increased by up to 20 p.p.). Districts in the Bratislava region are excluded from support. The investor has a maximum of 5 years for the project implementation (7 years for large-scale projects). In the case of job creation, the investor has a maximum of 8 years to create the new positions (10 years for large-scale projects).

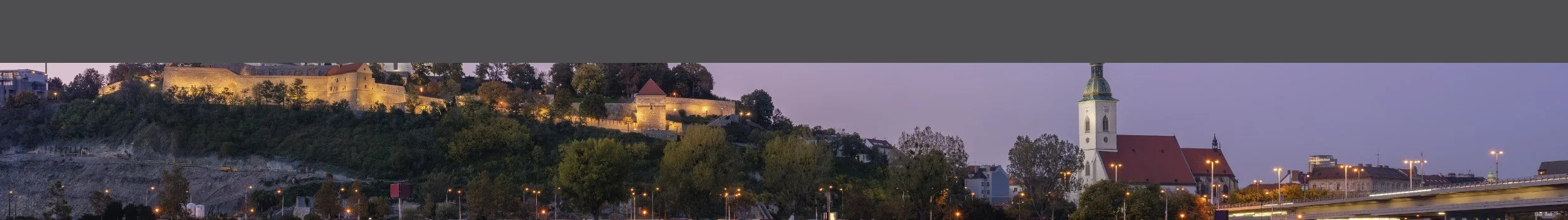

Capital: Bratislava

Surface area: 49,030 km²

Population: 5.5 mil

Unemployment: 6.1%

Currency: Euro

GDP growth: 1.7%

FDI net inflow (% of GDP) in 2021: 0.8%

Prospective sectors: Automotive, food, machinery, aerospace, electronics, chemical and pharmaceutical, ICT, shared services.

Good to know: Slovakia ranks within the top 20 countries in the world with the highest number of installed robots in the production industry per 10,000 employees. When comparing countries based on the export of goods to GDP ratio, Slovakia is the most open EU member state.